Our portfolio on the market

Electricity MarketingA key cornerstone of our work is trading and direct marketing of electricity from the renewable energy plants of our parent company ENERPARC AG. The plant portfolio managed by Sunnic now has a total capacity of around 6 GW and consists of roughly equal parts wind and solar power. Our wind power comes from both onshore and offshore farms.

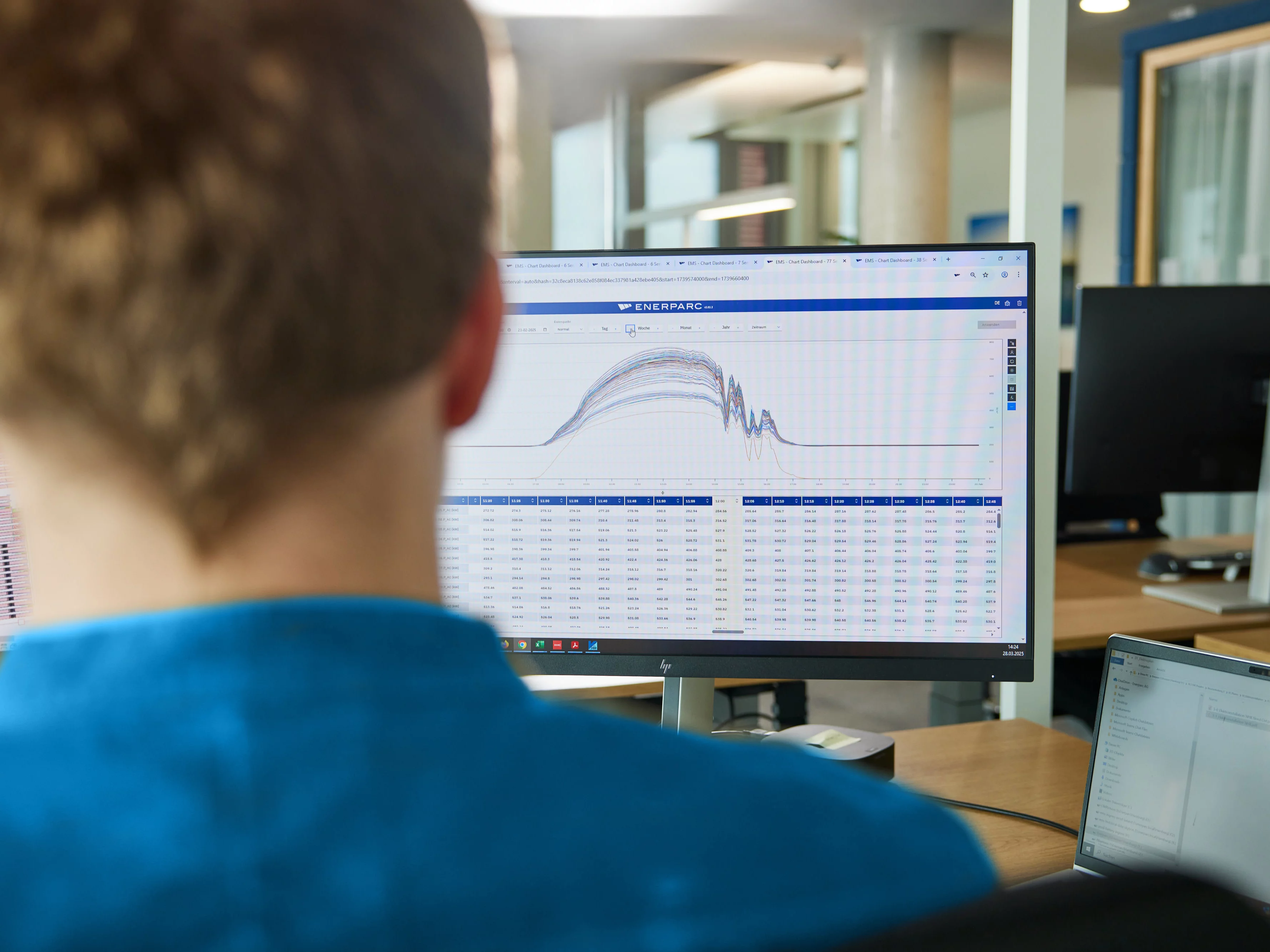

In our case, marketing or trading means trading the electricity produced by the photovoltaic and wind power plants as optimally as possible—i.e., selling it at high prices on the market or, if we produce less than anticipated, buying it back at a favorable price. Marketing takes place in several stages: the day-ahead auction and intraday trading.

day-ahead auction

Today for tomorrowThe first and one of the most important stages is the day-ahead auction, which always takes place at 12:00 noon on the EPEX or EXAA electricity exchange. Here, we can already trade a large portion of the production volumes forecast for the coming day.

All sellers and buyers in the European electricity market can submit their bids in the day-ahead auction. These bids are then collated by the exchange. This results in day-ahead prices for each hour of the following day. These auction prices serve as our benchmark for the next day.

We spend most of the morning preparing for the day-ahead auction, assessing tomorrow's weather and market conditions. To do this, we look at various sources and forecasts for our own production as well as for the entire German and European market.

Not only production itself, but also demand, imports, and exports are relevant factors that we evaluate and use to position ourselves for the following day.

We also participate in two smaller auctions: the EXAA auction at 10:15 a.m. and the EPEX auction at 3:00 p.m. Significantly smaller volumes are traded here, and the auctions can be used for optimization purposes.

intraday trading

Direct and to the pointThe next stage is intraday trading. Here, we can trade up to 5 minutes before the start of the next hour. This means we try to place our production optimally almost until the last minute.

To ensure the successful placement of our bids, we continuously analyze our live production. At the same time, we monitor satellite images showing cloud fields, for example, and naturally keep an eye on current market developments.

In intraday trading, we have to react as quickly as possible to changes in forecasts. We are also supported by various algorithms that we have developed ourselves, which evaluate indicators and signals from the market in the background and make trading decisions themselves.

We are happy to advise you!

Contact our sales team now:

Gela Aragvishvili, Head of Sales

sales@sunnic.de

T: +49 40 756 64 49 - 660